Use Case

Global Market Efficiency Impact

C. Tiu, D. Rösch, B. Wolfe (University at Buffalo) with S. Titman, K. Brown (University at Texas Austin), U. Yoeli (University of Texas), M. Carlson (University of British Columbia), A. Reed (TIAA), A. Subrahmanyam, R. Roll (UCLA), M. van Dijk, D. Bongaerts (Erasmus University)

What?

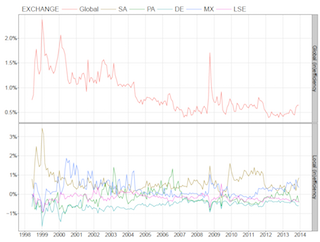

- Measure market efficiencies with high volumes of historical and current intraday market data

Why Aristotle?

- Bursting to integrate new data

- Tens of TBs moved to available processing resources

- Sharing data and pipelines around the world for collaboration and reproducibility

Accomplishments

- Developed the capability to migrate OpenNebula images to the cloud.

- Setup the framework on a VM and began to import and successfully analyze 2TBs of international tick-by-tick financial data from the Thomson Reuters Tick History (TRTH) database.

- Imported 25TBs Trade and Quote (TAQ) data up until 2017 for intraday trades and quote transactions for all US exchange-listed stocks, and computed 9 measures of efficiency.

- Created VMs in collaboration with Varun Chandola and Jialiang Jiang (UB) that share the same image and hold all the data; they are executing well.

- Demonstrated the framework to PhD students so they can analyze the data independently on Aristotle.

- Launched new investigations, i.e., how price deviations (market inefficiencies) affect liquidity (the ease at which you can buy or sell), how the recent increase in tick-size (the minimum price movement of US stocks) affects liquidity, etc.

- Gave a guest lecture at Cornell introducing the financial framework and data hosted on Aristotle.

Plans

- Use Aristotle and the financial framework to investigate whether human trades still matter at a time when trading is dominated by computers. Also, employ a LASSO regression to predict short-term stock returns using the whole cross-section of international stocks and investigate CumEx trading (labeled as the "Biggest Tax Heist Ever" by the NYTimes). All projects require large datasets and computational power. Collaborators include UCLA and the University of Utah.

- Continue to mentor PhD student researchers.

Products

- D. M. Rosch. A. Subrahmanyam & M.A. van Dijk (2021). Investor short-termism and real investment.. Journal of Financial Markets.

- J. Brogarrd, M.C. Ringgenberg & D. Rosch (2021). Does the Trading Floor Matter?. 8th Annual Conference on Financial Market Regulation.

- Presented "Does the Trading Floor Matter" at the 49th European Finance Annual Meeting in Milan (2021).

- Rosch, D. (2020). Financial market frictions. Presentation at the Cornell University Johnson School, Ithaca, NY.

- Hendershott, T., Livdan, D. & Roesch, D. (2020). Asset pricing: A tale of night and day. Journal of Financial Economics.

- Hendershott, T., Livdan, D. & Roesch, D. (2019). Asset pricing: A tale of night and day. Presentations at American Finance Association 2019 Annual Meeting, Atlanta, GA; Jackson Hole Finance Conference, Jackson Hole, WY; and, Desmarais Global Finance Research Centre, Montreal, Canada.

- Chung, K.H., Lee, A.J. & Rösch, D. (2019).

Tick size, liquidity for small and large orders, and price informativeness: evidence from the tick size pilot program.

Journal of Financial Economics (accepted).

- Hendershott, T., Livdan, D. & Rösch, D. (2018).

Asset pricing: a tale of night and day.

Presentation at the Research in Behavioral Finance Conference, Amsterdam, NL.

- Rösch, D. (2017).

Investigating the efficiency of financial stock markets with high-frequency data.

Presentation at the 2nd Federal Reserve Bank Economic Research in High Performance Computing Environments Workshop, Kansas City, KS.